does texas have an inheritance tax in 2020

The good news is that texas doesnt impose an estate or inheritance tax. There are no inheritance or estate taxes in Texas.

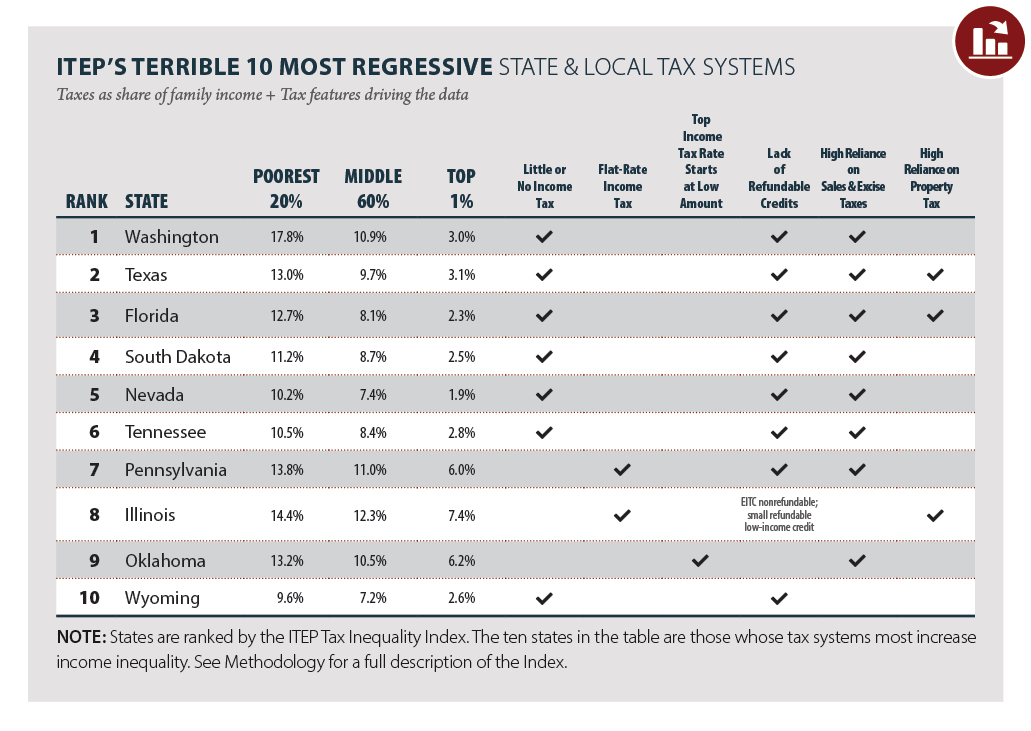

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Twelve states and the.

. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. An inheritance tax is a state tax placed on assets inherited from a deceased person. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

The state repealed the inheritance tax beginning on Sept. In 2011 estates are exempt from paying taxes. An inheritance tax requires beneficiaries to pay taxes on assets and properties inherited from a deceased person.

Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to. The short answer is no. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to.

However other stipulations might mean youll still get taxed on an inheritance. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Inheritance taxes differ from estate taxes as inheritance.

There is a 40 percent federal tax however on estates over 534. This increases to 3 million in 2020 Mississippi. The estate tax rate is currently 40.

Inheritance taxes in Texas. On the one hand Texas does not have an inheritance tax. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if it earns any income for.

Inheritance Tax Laws in Texas. There are not any estate or inheritance taxes in the state of Texas. With a base payment of 345800 on the first 1000000 of the estate.

If you have a gross estate of 1556 million 1206. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a 40 percent federal tax however on estates over 534.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. That said you will likely have to file some taxes on. How much can you inherit without paying taxes in 2020.

Texas is one of a handful of states that does not have an inheritance tax. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. There are no inheritance or estate taxes in texas.

There is also no inheritance tax in Texas. There are no inheritance or estate taxes in Texas. There is a 40 percent federal tax however on estates over 534.

The Inheritance tax in Texas. Ada banyak pertanyaan tentang inheritance tax in texas 2022 beserta jawabannya di sini atau Kamu bisa mencari soalpertanyaan lain yang berkaitan dengan inheritance tax in texas 2022. However a Texan resident who inherits a property from a state that does have such tax.

September 2 2020. Does Texas Have an Inheritance Tax or Estate Tax. When someone dies their estate goes through a legal process known as probate.

The state of Texas does not have an inheritance tax. There is a 40 percent federal tax. The inheritance tax is paid by the person who inherits the assets and rates vary depending on.

Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state inheritance taxes. The federal government eliminated inheritance. However other states inheritance taxes may apply to you if a loved one who lives in those states.

Death Tax In Texas Estate Inheritance Tax Law In Tx

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Must I Pay Taxes On An Inheritance From Foreign Relative

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Federal Estate Tax And Gift Tax Limits Announced For 2020 By Paul Goeringer Medium

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Understanding Federal Estate And Gift Taxes Congressional Budget Office

/https://static.texastribune.org/media/files/d1e98fb8f28a8457df679192b4fa976b/2022Elections-glossary-leadart-v1.png)

Texas Governor Lieutenant Governor And More What Do These Offices Do The Texas Tribune

Kentucky Estate Tax Everything You Need To Know Smartasset

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Restaurant Industry Battered By Statewide Shutdown

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

3 Transfer Taxes To Avoid In Your Houston Estate Plan

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj